Traders fear collapse of small businesses as state progresses with eTIMS, SHIF systems

By Charity Kilei |

They say that on top of struggling to understand SHIF calculations and the eTIMS systems, they are worried that the payments will leave them unable to sustain their businesses.

Many Kenyans are in a state of uncertainty even as the government plans to roll out the Social Health Insurance Fund (SHIF) on July 1 to replace the National Health Insurance Fund (NHIF), which has served Kenyans for 57 years.

This is especially true for small business owners and the unemployed, who are struggling to understand SHIF calculations and the Electronic Tax Invoice Management System (eTIMS).

Keep reading

Steven Wamalwa, an electronics repairman based in the California area of Eastleigh in Nairobi, feels the pressure mounting on both his business and family.

"Running a repair shop is unpredictable. On some days we don’t see a single customer, and when money does come in, there are so many demands that we can't keep track of our costs," he told The Eastleigh Voice in an interview on Monday.

Wamalwa explained that the high costs of rent and daily expenses make it nearly impossible to manage his finances.

"I haven't been able to pay the rent for months now. And with the new SHIF, the government wants me to calculate my income for health insurance and taxes. But if I can't figure out what I earn each month, how am I supposed to handle all these payments?"

He also noted that his entire family relies on his income, which barely covers basic needs.

"On a good day, I might make around Sh550. But often, people abandon their goods or don't pay. This money has to cover food, shop expenses, and house rent. How am I supposed to track all this, pay taxes through eTIMS, and also afford health insurance?"

He noted the need for the government to understand the struggles of small-scale traders.

"If it gets to the point where I have to pay for all these things, it might be better to close down and go home. It's just impossible to balance everything."

Food items sold at a small scale vegetable business in Eastleigh, Nairobi, are pictured on June 10, 2024. (Photo: Charity Kilei/EV)

Food items sold at a small scale vegetable business in Eastleigh, Nairobi, are pictured on June 10, 2024. (Photo: Charity Kilei/EV)

Multiple struggles

Anne Wambui, a vegetable vendor in Eastleigh, said she was going through a tough business season.

“I took a loan to start this business, and everything I earn goes towards repaying it. I'm struggling to feed my family, and even the thought of registering for eTIMS feels impossible," she said.

Wambui said she wanted to keep track of her sales through eTIMS but that she was already feeling overwhelmed and SHIF calculations were unclear to her.

“Now, on top of paying rent for my stall, school fees, and managing my finances, I have to figure out how to pay for SHIF. It’s too complex for me."

She also noted the possibility of closing her business as a result of the burden.

“Many people resort to self-employment because they can't find jobs elsewhere but if the little we make is eaten up by taxes and complicated requirements, it means we’ll just have to close down and wait for what happens next.”

Wambui further commented on Finance Bill 2024, which is set to increase costs for small business owners like her.

“We voted for this government because we believed it cared about small-scale businesses, but how do you explain all these heavy taxes that are already hurting our businesses? If I can't even understand how SHIF works, how am I supposed to remit payments?”

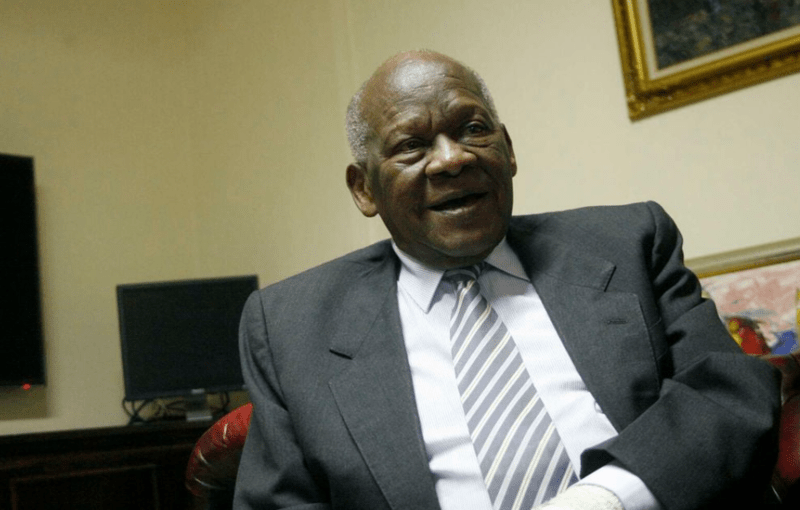

Health CS Susan Nakhumicha delivers President William Ruto's speech during the dissemination of the Fourth Medium Term Plan 2023-2027 (MTP IV) at the Kitale National Polytechnic in Trans Nzoia County on June 10, 2024. (Photo: Susan Nakhumicha)

Health CS Susan Nakhumicha delivers President William Ruto's speech during the dissemination of the Fourth Medium Term Plan 2023-2027 (MTP IV) at the Kitale National Polytechnic in Trans Nzoia County on June 10, 2024. (Photo: Susan Nakhumicha)

Clear guidelines necessary

Jane Aoko, a food vendor in Eastleigh, also voiced frustration, saying, "It used to be straightforward to pay NHIF, but now we're expected to self-declare and manage things we're not familiar with."

Aoko urged the government to simplify these processes, emphasising that while she and other small-scale traders "support contributing to taxes and medical insurance," the complexity makes it challenging.

"We want to contribute, but it's tough when we're living hand-to-mouth."

She also called for clearer guidelines and support to ensure that small businesses like hers can comply "without undue hardship."

Self-declaration

In a Citizen TV interview on Sunday, Health Cabinet Secretary Susan Nakhumicha discussed the SHIF approach for people in self-employment.

"We have people who are not in formal employment; they are self-employed and, of course, know their income. We have developed a scientific tool that is self-testing," she said. "It allows individuals to declare their monthly income, and the tool calculates the required 2.75 per cent contribution."

According to CS Nakhumicha, this tool enhances self-declaration.

"If you are not formally employed but have some form of income, you can still self-declare your earnings, and the tool will calculate the 2.75 per cent contribution," she explained.

Nakhumicha added that for those with zero income, the tool should determine this, placing them in the category of indigent individuals who need government assistance.

A file picture of Mary Muthoni, the Principal Secretary in the State Department for Public Health and Professional Standards. (Photo: X/Mary Muthoni)

A file picture of Mary Muthoni, the Principal Secretary in the State Department for Public Health and Professional Standards. (Photo: X/Mary Muthoni)

"No cause for alarm"

Speaking at Gichugu Mburi ACK Church on Sunday, Public Health Principal Secretary Mary Muthoni highlighted the government's dedication to ensuring the new health scheme is successfully implemented to provide efficient healthcare for all citizens.

"There is no cause for alarm. Kenyans can continue using their National Health Insurance Fund (NHIF) cards to access health services in all health facilities," said Muthoni. She noted that the NHIF card remains active for all Kenyans.

"Once fully implemented, the social health insurance scheme will require Kenyans to pay Sh300 per month, a reduction from the previous Sh500 in the NHIF programme," she noted.

She urged Kenyans to avoid politicising the programme and to be patient as the government takes the necessary steps to roll out the insurance coverage to everyone.

Appearing before the Senate in April, Nakhumicha revealed that hospitals are owed Sh30 billion, with Sh22 billion attributed to government institutions.

To address the debt, Nakhumicha announced the release of Sh8.5 billion, with Sh5.5 billion from the Treasury and Sh3 billion from NHIF reserves.